Goods and Services Tax (GST) is the biggest tax reform in India after independence. It is a tax trigger, which will lead to business transformation for all major industries. It is considered to have major long-term benefits in the economic revolution of India.

Here’s all you need to know about the GST :

CONCEPT

The Goods & Services Tax (GST) is a proposed system of indirect taxation in India. This will merge most of the existing taxes into one single tax system. It was introduced as The Constitution (101st) Amendment Act 2016 in the Parliament on 8 August 2016.

GST would be a comprehensive indirect tax on production, sale or consumption of goods and services across India. It will replace any existing taxes imposed by the central or state governments.

The main architects behind the successful placement of GST in the Parliament is the West Bengal finance minister Asim Dasgupta, Chairman of the 13th Finance Commission Vijay Kelkar, P Chidambaram and the Finance Minister of India Arun Jaitley.

The Goods and Services Tax is scheduled to roll-out on 1 July,2017.

FOUR BILLS FOR GST

The Government of India introduced four bills for GST in the Lok Sabha in March 2017 and Rajya Sabha in April 2017.

- The Central Goods and Services Tax (CGST) bill.

- The Integrated Goods and Services Tax (IGST) bill.

- The Goods and Services Tax (Compensation to States) bill.

- The Union Territory Goods and Services Tax (UTGST) bill.

The four GST bills have been passed by both the houses of Parliament of India in the year 2017. However, there will be no GST on trading of securities. It will continue to be governed by Securities Transaction Tax (STT).

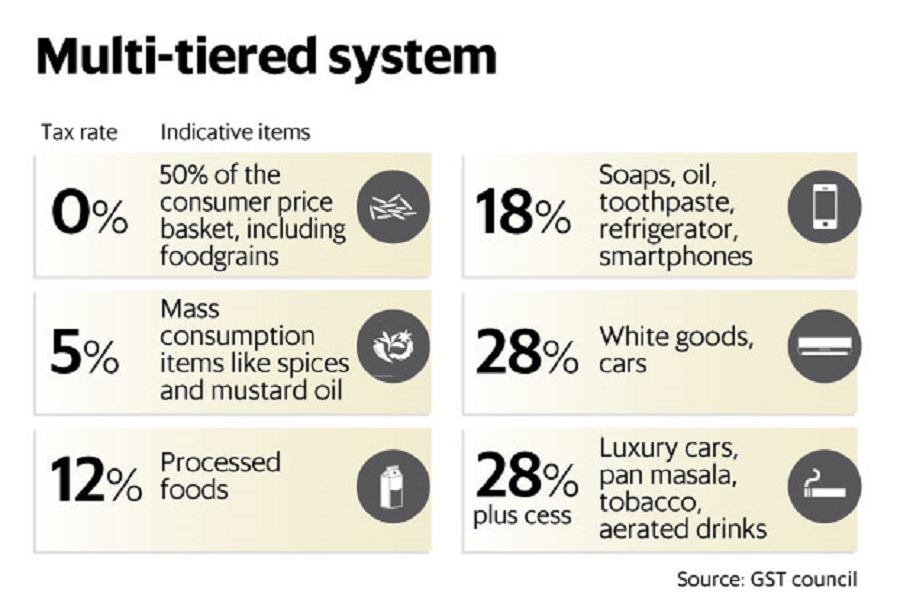

RATE SLABS

- 0% – Zero-rated Items (consists 50% of essential food items i.e. foodgrains, medicines, etc.)

- 5% – Essential Supplies (spices, tea, mustard oil, etc.)

- 12% – Standard Rate for Goods and Services (gold, jewellery, etc.)

- 18% – Standard Rate for Goods and Services (gold, jewellery, etc.)

- 28% – Expected Rate for Goods currently taxed @more than 30% (includes Luxury and Demerit Items plus cess)

The above rate slabs for the products are as per the latest announcements (12.04.2017) by the GST Council.

BENEFITS OF GST

Advantages

- Wider tax base

- Elimination of multiplicity of taxes and their cascading effects

- Rationalization of tax structure & simplification of compliance procedures

- Harmonization of Center and State tax administrations

- Automation of compliance procedures

Destination Principle

The GST structure would follow the destination principle. Accordingly, imports will be including GST, while exports will not charged for it. In the case of Inter-State transactions within India, the State tax would apply in the State of destination as opposed to that of origin.

Taxes to be subsumed

GST would replace most indirect taxes currently in place such as:

| Central Taxes | State Taxes |

|---|---|

|

|

DIFFICULTIES IN GST IMPLEMENTATION

Difficulties Surpassed (Before Implementation)

- Passing of GST Bill in Rajya Sabha

- Consent of States

Difficulties Yet To Be Solved (after Rollout)

- Revenue Neutral Rate (RNR)

- Threshold Limit in GST

- Robust IT Network

- Extensive Training to Tax Administration Staff

- Additional Levy

GSTN

Goods and Services Tax Network (GSTN) is a non-profit organisation formed to create a platform for all the concerned parties i.e. stakeholders, government, taxpayers to collaborate on a single portal.

The portal will be accessible to the central government which will track down every transaction on its end while the taxpayers will be having a vast service to return file their taxes and maintain the details online.

The IT network will be developed by private firms which are being in tie up with the central government. The private banks will have 51% stake in the authorised capital of GSTN. Whereas, the Central government holds 24.5 percent of shares and the State Government holds 24.5 percent.

ITS IMPLEMENTATION

The Goods and Services Tax is currently scheduled to be implemented by 1 July, 2017 as deadline.

P. Chidambaram quoted this deadline as impractical and undesirable. He said so because the bill is still “imperfect” and requires amendments. He proposes the date to postpone to 1 October, 2017 for the implementation of the tax regime.

So, let’s get ready to have “ONE NATION, ONE TAX” !

Like us on Facebook. ?